There’s no denying the frustration that comes with discovering hail damage to your property. Fortunately, knowing how to navigate the process of filing a claim with your insurance company can help alleviate some of the stress. In this comprehensive guide, we will walk you through the necessary steps to take when dealing with hail damage and working with your insurance provider. From assessing the damage to understanding your policy coverage, we will equip you with the knowledge and tools necessary to ensure a smooth and successful claims process. Let’s dive in and get you on the path to recovering from hail damage with confidence. If you need roofing services in Denver after a hail storm reach out to us!

It is crucial to understand the type of coverage your insurance policy provides for hail damage. Storm damage coverage can vary depending on the policy you have and the insurance company you are with. Knowing the specifics of your coverage will help you navigate the claims process smoothly.

In terms of hail damage coverage, there are typically two main types of insurance policies: Actual Cash Value (ACV) and Replacement Cost Value (RCV). The type of policy you have will determine how much you will receive in the event of a storm damage claim. It is important to review your policy and understand the differences between these two coverage options.

| Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

| – Takes depreciation into account | – Does not take depreciation into account |

| – Generally less expensive | – Typically more expensive |

| – Pays out the current value of damaged items | – Pays to replace damaged items with new ones |

| – Lower upfront costs | – Higher upfront costs |

| – May require out-of-pocket expenses | – Covers full replacement cost |

Storm damage claims can be impacted by various factors that may influence the outcome of your claim. Understanding these factors will help you prepare and possibly increase your chances of a successful claim process.

Hail damage claims can be affected by several factors that play a significant role in determining the outcome of your claim. It is important to keep these factors in mind when filing a storm damage claim to ensure a smooth and successful process.

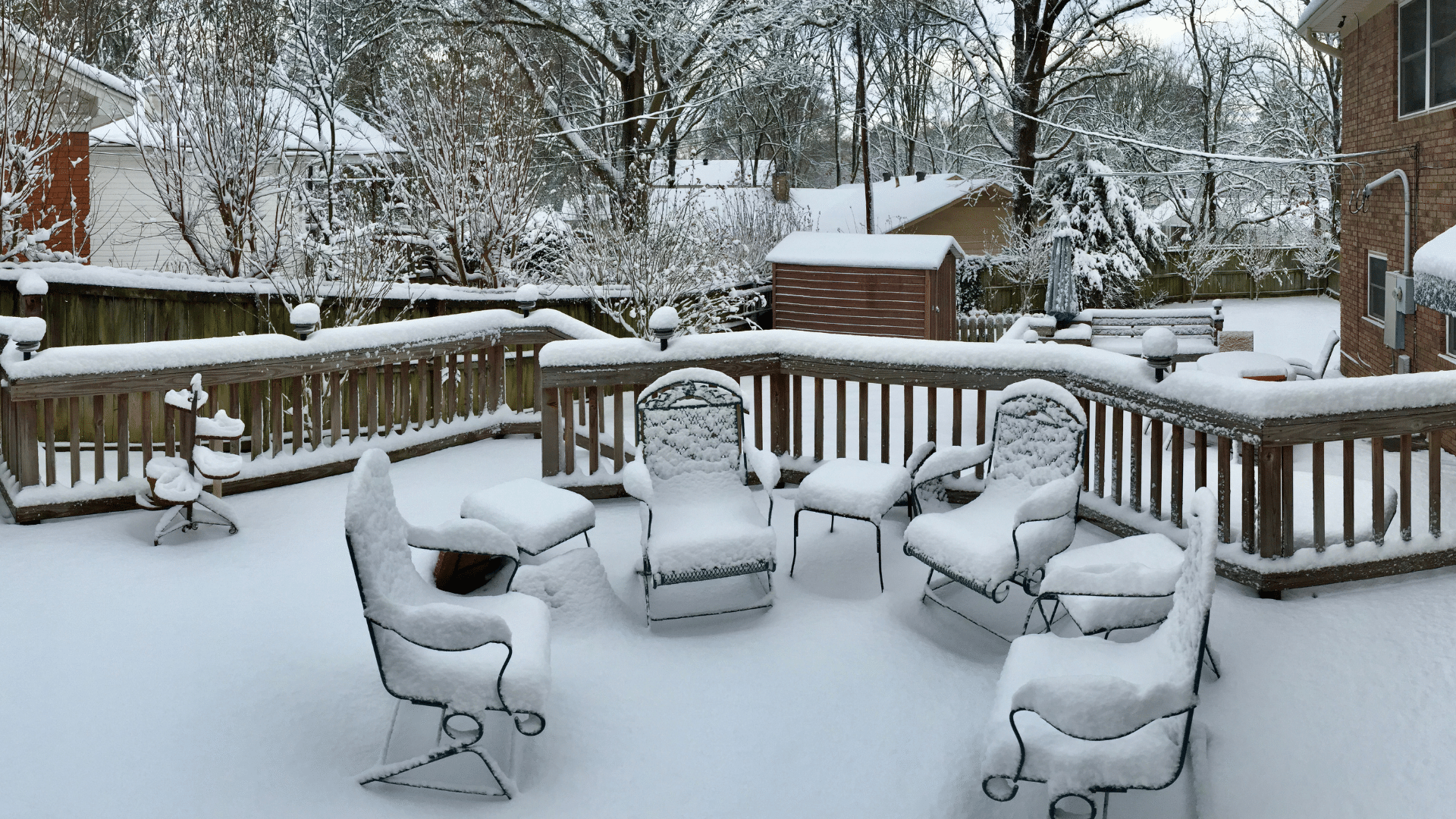

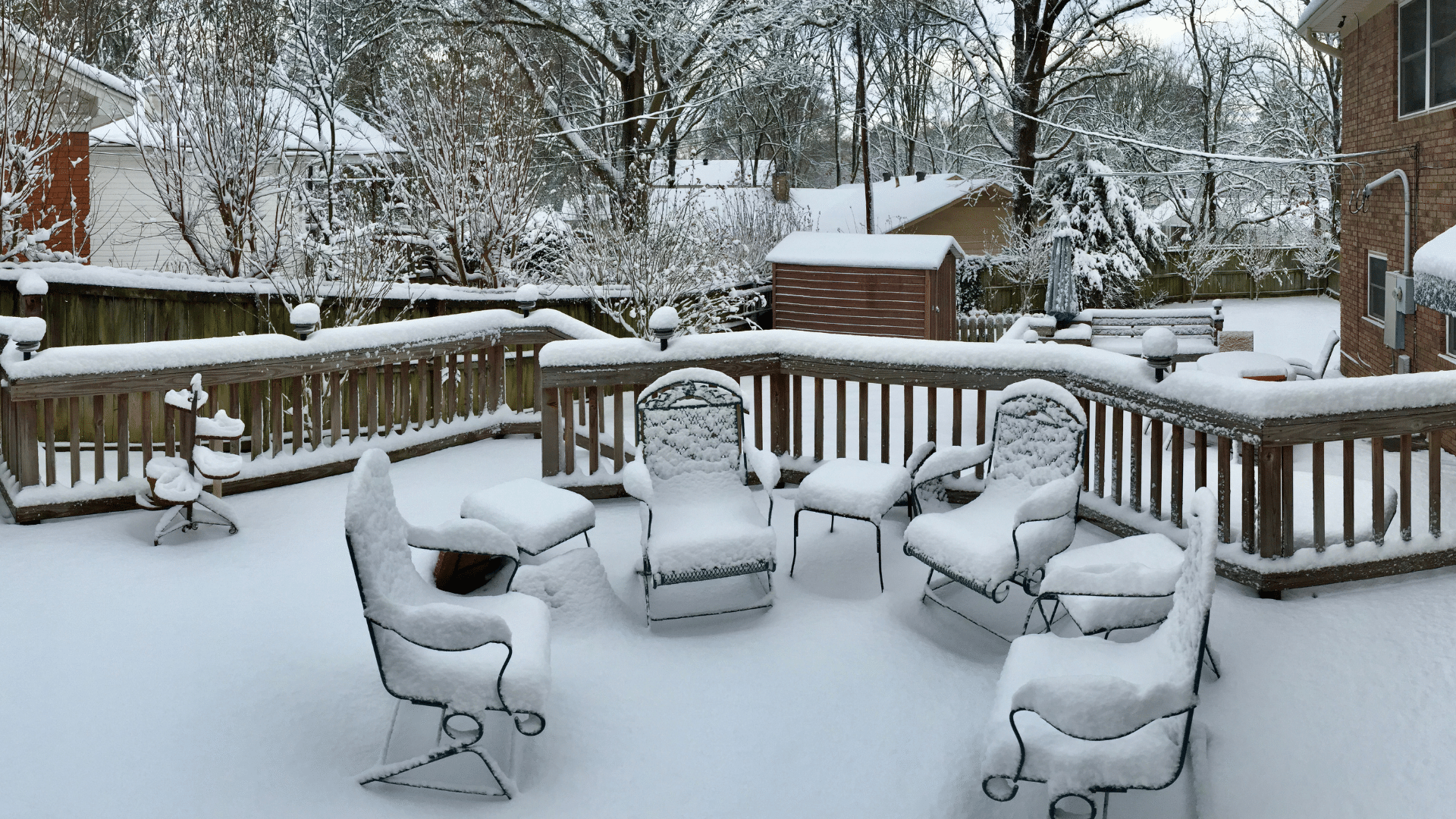

One of the most critical steps in filing a storm damage claim is properly documenting the damage to your property. Take detailed photographs and videos of the affected areas from multiple angles. Note the date and time of the hailstorm and keep all receipts from repairs or replacements.

Recognizing the extent of the damage and having thorough documentation will help support your claim and ensure fair compensation from your insurance company.

Contact your insurance company as soon as possible after the hailstorm. Provide them with your policy information and a detailed description of the damage.

One important aspect of filing a storm damage claim is contacting your insurance company promptly. Be prepared to provide your policy details, a description of the damage, and any documentation you have gathered. This will streamline the claims process and prevent any delays in getting the compensation you need to repair your property.

Once again, you’ve experienced hail damage to your property and need to file a claim with your insurance company. The process can be overwhelming, but understanding how to navigate it can help you get the compensation you deserve.

Some insurance companies will send out an adjuster to assess the hail damage to your property. During this phase, the adjuster will inspect the extent of the damage and determine the cost of repairs or replacement. It’s important to be present during this inspection to ensure all damage is documented accurately.

| Pros | Cons |

| Financial compensation for repairs | Potential increase in insurance premiums |

| Protection against further damage | Possible denial of claim |

| Peace of mind | Time-consuming process |

On the one hand, filing a hail damage claim can provide you with financial compensation for repairs and protection against further damage. On the other hand, there is a risk of a potential increase in insurance premiums and the possibility of a denied claim. Additionally, the process can be time-consuming, requiring documentation and negotiations with the insurance company.

Your communication with your insurance adjuster is crucial in ensuring a smooth resolution to your hail damage claim. Be sure to document all interactions, keep detailed records of any conversations, and provide clear and accurate information about the damage. It’s necessary to respond promptly to any requests for additional documentation or information. When discussing your claim, remain professional and avoid confrontational language.

Recognizing the importance of effective communication can help expedite the resolution of your claim and ensure a positive outcome.

On the occasion that your hail damage claim is denied, it is necessary to take action promptly. Start by reviewing the denial letter carefully to understand the reasons for the denial. Contact your insurance company to request a detailed explanation of the denial and gather any additional evidence or documentation that may support your claim. Consider consulting with a public adjuster or an attorney specializing in insurance claims to explore further options for appeal or resolution.

This proactive approach can increase your chances of successfully overturning a denied claim and receiving the compensation you deserve for your hail damage.

When filing a hail damage claim with your insurance company, follow these steps: document the damage with photos, contact your insurance company promptly, schedule an inspection with an adjuster, obtain repair estimates, and stay in communication with your insurance company throughout the claims process.

The claims process for filing a hail damage claim typically involves contacting your insurance company to report the damage, scheduling an inspection with an adjuster, receiving an estimate for repairs, and then either receiving a payment or having the repairs done by a preferred contractor. Your insurance company will guide you through each step of the process.

When filing a hail damage claim, review your insurance policy for coverage details related to hail damage, deductibles, coverage limits, and any exclusions that may apply. It’s important to understand what is and isn’t covered by your policy to avoid any surprises during the claims process.

Now that you have the tools and knowledge necessary to successfully file a hail damage claim with your insurance company, remember to document all damage, contact your agent promptly, and be prepared to provide evidence of the extent of the damage. By following these steps and staying organized throughout the claims process, you can ensure a smoother and more successful experience with your insurance company. Don’t hesitate to seek guidance from professionals if needed, and remember that staying proactive and informed is key to receiving the compensation you deserve for hail damage to your property. Contact us if you need assistance on your roof after a hail storm.

Follow us on Facebook to stay up to date with our latest blog posts!